iowa city homestead tax credit

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Geothermal Heating Cooling System Property Tax Exemption.

Property Tax Homestead Exemptions Itep

Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone.

. It must be postmarked by July 1. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Sioux City IA 51101 Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption.

Learn About Sales. This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed. 2015 HF 166 Veterans Credit modifying eligibility PDF Iowa Family Farm Land Credit.

This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount which does not. The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the homestead tax credit application. It is also the property owners responsibility to report to the Assessor when they are no longer eligible for any credit or exemption.

Iowa law provides for a number of credits and exemptions. No homestead tax credit shall be allowed unless the first application for homestead tax credit is signed by the owner of the property or the owners qualified designee and filed with the city or county assessor on or before July 1 of the current assessment year. NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. The credit will continue without further signing as long as it continues to qualify or until is is sold. Claim the property as their primary residence as opposed to a second home.

Iowa Code Section 4271 38 Iowa Administrative Rule 70--8029427 Eligibility. 54-028a 090721 IOWA. Iowa City Assessor 913 S.

Any applications received after that date will not be applied until the following year when property taxes are re-calculated. Homestead Tax Credit Sign up deadline. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

To the Assessors Office of _____ CountyCity Application for Homestead Tax Credit Iowa Code Section 425. Homestead Tax Credit Iowa Code chapter 425. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

54-028a 121619 IOWA. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Iowa Special Assessment Credit 54036 Author.

Persons in the military or nursing homes who do not occupy the. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed.

Learn About Property Tax. Tax Credits. Upon filing and allowance of the claim the claim is allowed on that.

The deadline is July 1st. Applications can be completed at our office or obtained online by clicking on Additional. Upon filing and allowance of the claim the claim is allowed on that.

In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. 8011 Application for credit. 52240 The Homestead Credit is available to all homeowners who own and occupy the.

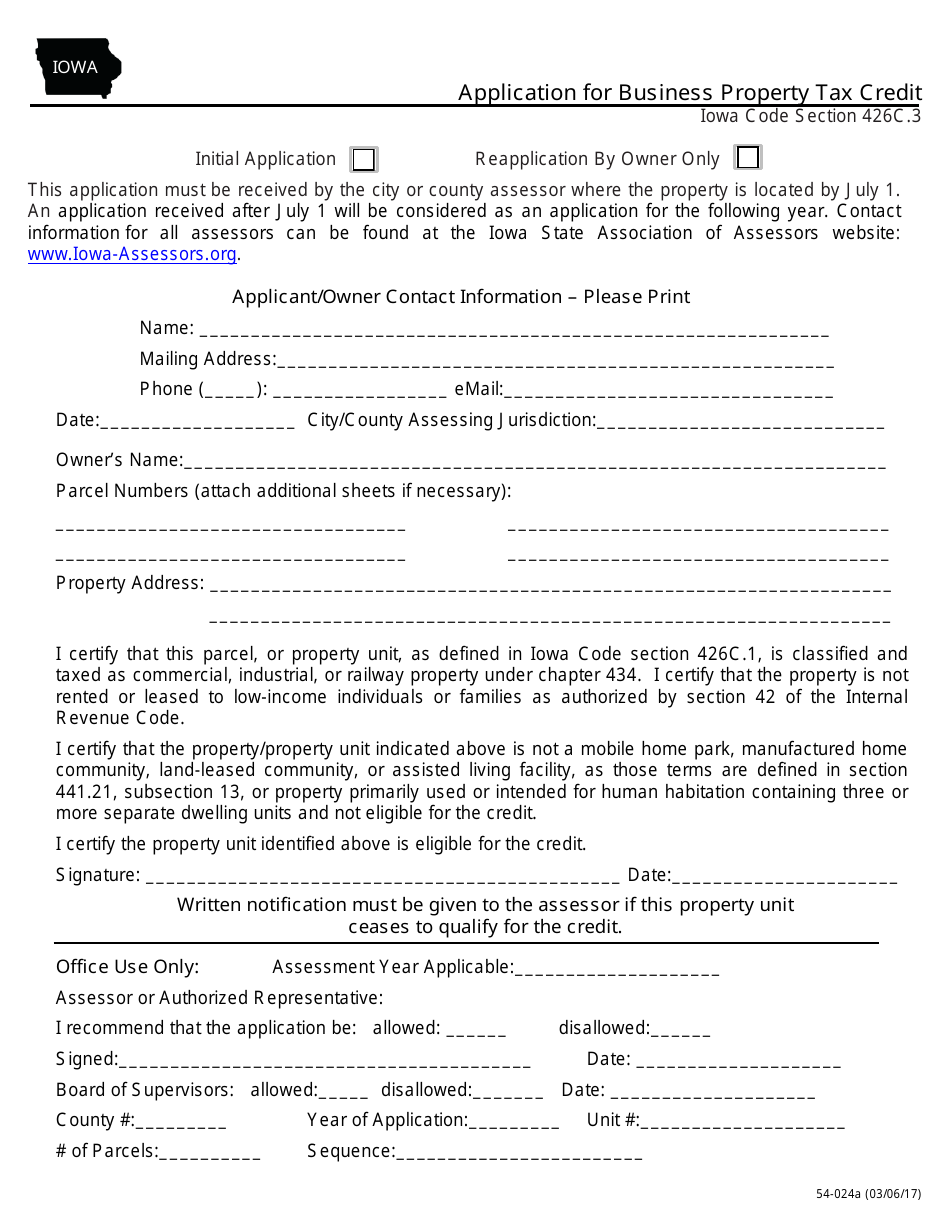

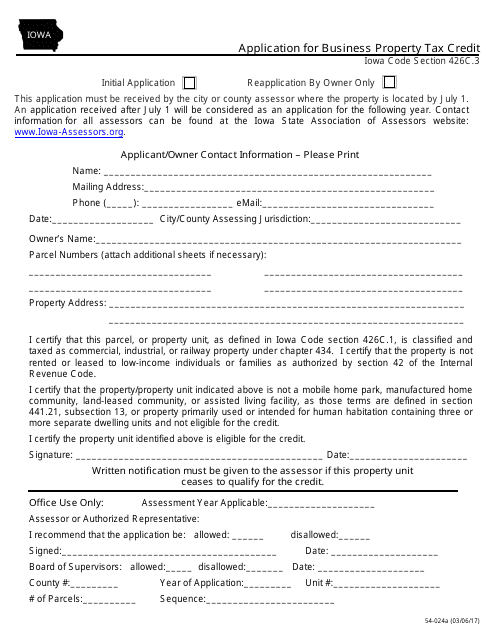

Occupy the residence for at least six months of the year. Brad Comer Assessor Marty Burkle Chief Deputy Assessor. Business Property Tax Credit BPTC From the Iowa Department of Revenue.

Of Veterans Affairs press release PDF Application Form. 701801425 Homestead tax credit. You only need apply one time and the credit will be applied to your property taxes every year as long as you live in the house.

It is the property owners responsibility to apply for these as provided by law. Declare residency in Iowa. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa.

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. Law. Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year.

Dubuque Street Iowa City IA 52240 Voice. The tax year runs from July 1 to June 30 in Johnson County. Upon filing and allowance of the claim the claim is allowed on.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first. Refer to Iowa Dept. File a W-2 or 1099.

Adopted and Filed Rules. Application for Homestead Tax Credit IDR 54-028 111014 This application must be filed with your city or county assessor by July 1 of the year for which the credit is first. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. It is the property owners responsibility to apply for these as provided by law. This credit must be filed with the assessor by July 1 annually.

Geothermal heating or cooling system must have been installed on or after July 1 2012. The amount of the credit is a maximum of the entire amount of tax payable on the homestead. 54-028 012618 IOWA.

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the. The current credit is equal to the actual tax levy on the first 4850 of actual value. Iowa Department of Revenue Created.

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

/GettyImages-77332455-577f3a8c5f9b5831b5dd010f.jpg)

What Is A Property Tax Circuit Breaker

What Is A Homestead Exemption And How Does It Work Lendingtree

Homestead Tax Credit Johnson County Iowa Homestead Tax Credit Youtube

Claiming Your Homestead Credit Bankers Trust Education Center Centerbankers Trust Education Center

Form 59 458 Fillable Homestead Tax Military Service Credit Notice Of Transfer Or Change In Use Of Property

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

Form 54 024a Download Fillable Pdf Or Fill Online Application For Business Property Tax Credit Iowa Templateroller

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

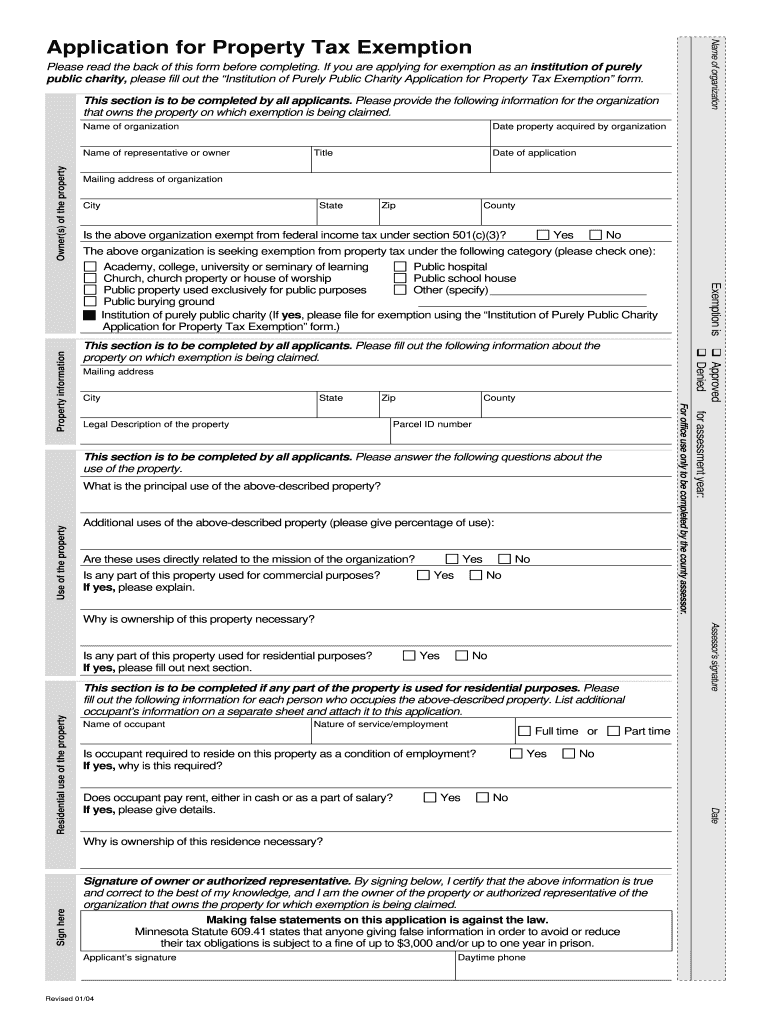

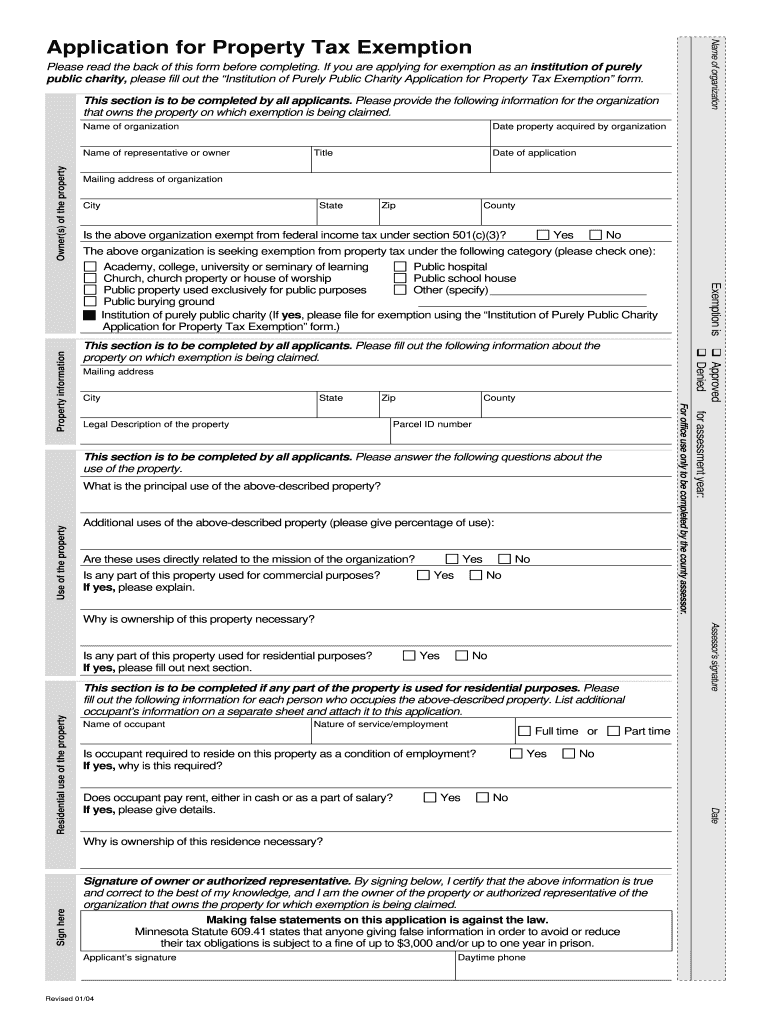

Mn Application For Property Tax Exemption Carver County 2004 2022 Fill Out Tax Template Online Us Legal Forms